avtoelektrik-skt.ru

Recently Added

What Are The Best Sectors To Invest In 2021

The US stock market has long been considered the source of the greatest returns for investors, outperforming all other types of investments. Lessons in Investment Promotion: The Case of Invest India (July, ) Trust between Public and Private Sectors: The Path to Better Regulatory Compliance? Leaders: Energy = %; Real Estate = %; Financials = %. Laggards: Communication Services = An investment in GPE ripples out across sectors, generating impact for generations. Investments in school age girls have the highest returns in. Which sectors and/or geos do folks feel are the best value now - and why? · Energy · Materials · Industrials · Utilities · Healthcare · Financials. It encourages investors to use responsible investment to enhance returns and better PRI growth sig_growth-JULY+AOs. Source: Data and. The chart breaks down the annual S&P sector returns, ranked best to worst over the past fifteen years. investment in restricted sectors may move forward. The Commission has 45 invest in those companies deemed to meet internationally accepted criteria for good. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. The US stock market has long been considered the source of the greatest returns for investors, outperforming all other types of investments. Lessons in Investment Promotion: The Case of Invest India (July, ) Trust between Public and Private Sectors: The Path to Better Regulatory Compliance? Leaders: Energy = %; Real Estate = %; Financials = %. Laggards: Communication Services = An investment in GPE ripples out across sectors, generating impact for generations. Investments in school age girls have the highest returns in. Which sectors and/or geos do folks feel are the best value now - and why? · Energy · Materials · Industrials · Utilities · Healthcare · Financials. It encourages investors to use responsible investment to enhance returns and better PRI growth sig_growth-JULY+AOs. Source: Data and. The chart breaks down the annual S&P sector returns, ranked best to worst over the past fifteen years. investment in restricted sectors may move forward. The Commission has 45 invest in those companies deemed to meet internationally accepted criteria for good. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock.

Certain sectors perform better than others, so if the market is heading higher, we want to buy stocks within sectors that are performing the best. In other. Check out the latest developments in a wide range of German industry sectors. Issue | January 27, The Pharmaceutical Industry in Germany. Area of sector expertise. Aerospace and defence; Automotive; Construction; Materials handling; Electronics; Green growth and renewable energy; Consumer products. Some of the innovative sectors REITs spearheaded have included data centers, telecommunications towers, self-storage, health care, lodging, billboards, and. While style groupings can change (e.g., a company can go from growth to value), a company's sector classification usually stays the same, making it easier. Leaders: Energy = %; Real Estate = %; Financials = %. Laggards: Communication Services = They draw on emerging best practices from a range of asset managers February · October Impact Investing and the SDGs. The adoption of the. sectors of the financial markets, including ours. As they do so, they must best wishes, and I hope that we in ICI Research will be able to see many. Blended finance is the use of catalytic capital from public or philanthropic sources to increase private sector investment in sustainable development. Published May Licence CC BY · Press release. Share Cite. Scroll down Around 90% of existing capacity in heavy industries reaches end of. Best sectors to invest not only in next year but also for the long-term/forever. Diversify investments in growth companies/sectors- mainly. Which sectors/themes are you investing in, in ? ; Disruptive technology ; Environmental, Social and Governance (ESG) ; Clean tech/. The National Industry Policy (NIP) () designates the priority industries as follow: High priority sectors 1. Agriculture, food processing and. By engaging and investing in partnership, we will secure a better future for all. We cannot do this without the involvement of Canadians from every sector. This. Source for inflationary periods: Henry Neville, Teun Draaisma, Ben Funnell, Campbell R. Harvey and Otto Van Hemert, , “The Best Strategies for Inflationary. Research the performance of U.S. sectors & industries. Find the latest new and performance information on the markets and track the top global sectors. $21Bn. Investments Attracted. (Since ). Lakh Acres. (Largest Land Bank in India). MW. Solar Capacity. (2nd Highest in the country). FOCUS SECTORS. Sector-based investing is a popular strategy, but you need to understand how sectors interact based on things like recessions, interest rates, and changing. We invest all over the world across industries and asset classes. Learn more INVESTMENT: HEADQUARTERS: Hangzhou City, Zhejiang Province, China RELATED. top countries in preparedness for cyber attacks. Canada has a national cybersecurity strategy and launched a Cyber Security Innovation Network in

Average Cost To Replace Central Air Conditioning

$6K (last summer) for adding a 3-ton AC to an existing HVAC system/ducts. Super easy install as the furnace is in the garage. Electrical and. Homeowners will face an average cost of about $7, to replace their HVAC system in Depending on the size of the units you need and the age of the other. On average, consumers can expect to pay anywhere between $1, and $4, for a new central ac unit. Keep in mind: Those prices are for the actual AC unit. Average Cost to Repair an Air Conditioning Unit · Minor AC repairs – $ to $+ · Moderate/major AC repairs – $ to $1,+ · Compressor/coil replacement. The potential cost to repair or replace your HVAC unit can range up to $6,* for an individual unit to up to $34, for a whole new system** if you don't. HVAC replacement costs as low as $3, but can range from $5, to $12,, including installation costs. · Equipment type has the biggest influence on a new. One unit is ton and the other is a 2 ton. I just had a guy out to the house that stated new units with 16 SEER rating would cost me $30, A new central AC unit will typically cost between $1, and $2,, depending on the size and complexity of the project. However, if ductwork needs to be. Typically, ductwork costs between $10 and $20 per linear foot, with an average requirement ranging from 50 to feet. Factor in these additional expenses when. $6K (last summer) for adding a 3-ton AC to an existing HVAC system/ducts. Super easy install as the furnace is in the garage. Electrical and. Homeowners will face an average cost of about $7, to replace their HVAC system in Depending on the size of the units you need and the age of the other. On average, consumers can expect to pay anywhere between $1, and $4, for a new central ac unit. Keep in mind: Those prices are for the actual AC unit. Average Cost to Repair an Air Conditioning Unit · Minor AC repairs – $ to $+ · Moderate/major AC repairs – $ to $1,+ · Compressor/coil replacement. The potential cost to repair or replace your HVAC unit can range up to $6,* for an individual unit to up to $34, for a whole new system** if you don't. HVAC replacement costs as low as $3, but can range from $5, to $12,, including installation costs. · Equipment type has the biggest influence on a new. One unit is ton and the other is a 2 ton. I just had a guy out to the house that stated new units with 16 SEER rating would cost me $30, A new central AC unit will typically cost between $1, and $2,, depending on the size and complexity of the project. However, if ductwork needs to be. Typically, ductwork costs between $10 and $20 per linear foot, with an average requirement ranging from 50 to feet. Factor in these additional expenses when.

The cost to replace both your furnace and your air conditioner at the same time ranges from $ to $+. These major factors will determine if it's. There are a lot of factors that go into an AC installation. Not only location, but also the manufacturer, the type of system, the size of your home, etc. AC replacement units run right in line with the national average of $ The typical range nationally falls between $ to $ Typical HVAC Replacement Costs By Type · Ductless Mini Split: $5, - $14, · Standard Air Conditioner/Condenser: $4, - $12, · Heat Pump: $4, - $12, You can expect to pay an average of $5, for AC replacement costs. Most homeowners pay between $3, and $7,, with your actual costs depending on the. Average Cost for High-End Systems: $10, to $15, These prices include the unit itself, installation labor, and any necessary modifications or additions. The national average cost for central air repairs is between $ and $, with most homeowners spending around $ to replace a broken thermostat. HVAC system prices can have a $2, difference in cost depending on the tonnage you need. A 2-ton HVAC replacement cost around $7,, while a 5-ton HVAC. The average cost is $ to $ this depends on what type of maintenance your system needs from basic maintenance to a deep cleaning. Most AC units—with the exception of small portable units—require the expertise of an HVAC contractor for installation. HVAC pros typically charge between $ The average cost of central air conditioning installation ranges from $5, to $12, in New Jersey. Meanwhile, replacement costs including labor can range. An HVAC replacement cost is $7, on average. This range could be as low as $5, or as high as $12,, depending on the type and size of your unit. A no frills, minimum efficiency air conditioner will cost you as little as $7, installed, while a full featured, high-end, high efficiency air conditioner. Air conditional Central air conditioners work to keep your entire home cool by circulating air through the cooling coils. Larger homes may need separate systems. In April the cost to Install Air Conditioning starts at $6, - $8, per unit. Use our Cost Calculator for cost estimate examples customized to the. The cost to replace an air conditioner depends on a number of factors but the average cost in Ontario is between $ and $ If your home does happen to already have central heating and ductwork, though, the cost to install central air is essentially cut in half. Again, for a 2, This is the most common type of HVAC system, which has two main units — one for cooling and one for heating. The cooling unit is typically located outside while. For a basic, two-ton model, expect your investment to start at $3,; a mid-range unit will run approximately $5,, and top-of-the-line A/C systems can creep. An air conditioner will cost more for larger homes. The typical range for smaller systems is about $3, For larger and upgraded systems, expect to pay around.

Tax Free Retirement Plans

With a traditional individual retirement account (IRA) or (k) plan, you don't pay ordinary income taxes on the money you're contributing. Instead, you'll be. The easiest way to avoid taxes on your retirement money is to use a Roth account. Both IRA and (k) plans can be structured as Roth accounts, which don't. 5-Step Tax-Smart Retirement Income Plan · Step 1: Start with your required minimum distributions (RMDs), if applicable · Step 2: Tap interest and dividends · Step. Annual Retirement Income Exclusion (R.S. (A))—Persons 65 years or older may exclude up to $6, of annual retirement income from their taxable. Your retirement contributions are not taxable, but interest included in the payment is taxable. You should contact the IRS for more information. The taxable. You contribute after-tax dollars, so your withdrawals later in life are tax-free. Having both a (k) and a Roth IRA allows you to diversify your portfolio and. A (b) plan (tax-sheltered annuity plan or TSA) is a retirement plan offered by public schools and certain charities. It's similar to a (k) plan maintained. Generally, with tax-qualified, tax-deferred retirement plans such as a traditional IRA, (k), or (b), all money taken out is treated as taxable income. ". IRAs are another way to save for retirement while reducing your taxable income. Depending on your income, you may be able to deduct any IRA contributions on. With a traditional individual retirement account (IRA) or (k) plan, you don't pay ordinary income taxes on the money you're contributing. Instead, you'll be. The easiest way to avoid taxes on your retirement money is to use a Roth account. Both IRA and (k) plans can be structured as Roth accounts, which don't. 5-Step Tax-Smart Retirement Income Plan · Step 1: Start with your required minimum distributions (RMDs), if applicable · Step 2: Tap interest and dividends · Step. Annual Retirement Income Exclusion (R.S. (A))—Persons 65 years or older may exclude up to $6, of annual retirement income from their taxable. Your retirement contributions are not taxable, but interest included in the payment is taxable. You should contact the IRS for more information. The taxable. You contribute after-tax dollars, so your withdrawals later in life are tax-free. Having both a (k) and a Roth IRA allows you to diversify your portfolio and. A (b) plan (tax-sheltered annuity plan or TSA) is a retirement plan offered by public schools and certain charities. It's similar to a (k) plan maintained. Generally, with tax-qualified, tax-deferred retirement plans such as a traditional IRA, (k), or (b), all money taken out is treated as taxable income. ". IRAs are another way to save for retirement while reducing your taxable income. Depending on your income, you may be able to deduct any IRA contributions on.

Contributions reduce your taxable income up to annual limits, investments grow tax-free, and you pay no tax on withdrawals for qualified medical expenses. Once. Roth IRA or Roth (k) qualified distributions are tax-free. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the. Assets held in qualified plans and IRAs normally generate no current income tax liability. The distribution of those assets to a participant or a participant's. Therefore, your distributions are usually taxable. A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account. Common tax-deferred retirement accounts are traditional IRAs and (k)s. Popular tax-exempt retirement accounts are Roth IRAs and Roth (k)s. An ideal tax-. Some (b) plans offer a Roth contribution option. Roth contributions are made after-tax, rather than before tax, and withdrawn tax-free at retirement if. Qualified taxpayers who are under age 65 as of the last day of the tax year can subtract the smaller of $20, or the taxable pension/annuity income included. tax-free in retirement Income taxes on matching funds also are deferred until savings are withdrawn. Roth (k) Plans. An employer-sponsored Roth What are some tax-saving moves to make before I am required to take distributions? · Converting taxable assets to a Roth IRA. · Selling investments that have. Roth retirement accounts. The Roth option allows you to contribute money without reducing your taxable income. These are referred to as after-tax contributions. This lowers your taxable income for the current year, which can save you money now, but you'll have to pay the taxes when you take the money out in retirement. A Roth IRA is a special individual retirement account (IRA) in which you pay taxes on contributions, and then all future withdrawals are tax-free. Roth IRA or Roth (k) qualified distributions are tax-free. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the. Employer plans, IRAs, and taxable accounts can all be used for retirement saving. Here are some options that may help you reach your retirement savings goals. 3. What retirement income qualifies for the exclusion? · Distributions from individual retirement plans (IRA) authorized under section of the Internal Revenue. Taxes on Pension Income You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, (k)s, Retirement and pension benefits include most income that is reported on Form R for federal tax purposes. This includes defined benefit pensions. What is the Wisconsin retirement income subtraction? Are my retirement benefits taxable? The taxation of your retirement benefits varies whether you are a full-. Your employer-sponsored retirement account is the most obvious way. · a ROTH account (individual or part of your (k), involves paying taxes. Your account balance grows tax-free until you take money out of it, and then you pay regular income tax on your withdrawals. If your total taxable income is.

Best Bank Apy Rates

I use Western Alliance Bank online with an APY of Us this referral and get $ James C. is giving you a cash bonus and helping you save! Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. American Express National Bank savings account · ; Jenius Bank savings account · ; Forbright Bank savings account · ; LendingClub savings account · Best high-yield online savings accounts ; MySavingsDirect High Interest Savings Account · No minimums and low fees · % · $0 · $0. Renew the CD at a term and rate that is best for you, To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account. To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account or CD must remain linked to a Prime Checking, Premier Checking. The CIT Bank Platinum Savings offers % APY on balances of $5, or more. Balances less than $5, earn only % APY. Standout benefits: In addition to. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. Currently, the top high-yield savings accounts pay up to % APY. These rates fluctuate and will likely change with the current economic environment. That. I use Western Alliance Bank online with an APY of Us this referral and get $ James C. is giving you a cash bonus and helping you save! Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. American Express National Bank savings account · ; Jenius Bank savings account · ; Forbright Bank savings account · ; LendingClub savings account · Best high-yield online savings accounts ; MySavingsDirect High Interest Savings Account · No minimums and low fees · % · $0 · $0. Renew the CD at a term and rate that is best for you, To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account. To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account or CD must remain linked to a Prime Checking, Premier Checking. The CIT Bank Platinum Savings offers % APY on balances of $5, or more. Balances less than $5, earn only % APY. Standout benefits: In addition to. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. Currently, the top high-yield savings accounts pay up to % APY. These rates fluctuate and will likely change with the current economic environment. That.

APY comparison ; Synchrony Bank, %, $0 ; Marcus by Goldman Sachs, %, $0 ; Capital One, %, $0 ; Discover Bank, %, $0. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Percentage Yield (APY). Hawaii's Best Checking, $, None, %. Money Market Checking, $1,, $0 to $, %. $1, or more, %. Teen or Student. Watch your savings grow with an account that offers competitive rates and terms that best fit your goals and lifestyle. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. Take advantage of today's rates and earn % APY on your entire account balance – that's more than 10 times the national average2. This eighth consecutive pause in rate hikes means the federal funds rate, a key bank lending rate, will remain at a target range of % to %, the highest. Variable Rate Products for Consumer Customers ; , ; , Star Savings Account. Balance Tier All Balances. Interest Rate %. Annual Percentage Yield (APY) %. Available in all states. The top savings accounts rates on Raisin. Offered by FDIC-insured banks and NCUA-insured credit unions. Start with as little as $1 and no fees. Learn more. While several competitors on this list have no minimum deposit, My Banking Direct's % APY is more than enough to make up for a $ minimum deposit. UFB Direct's savings account rivals competitors in rate, with a % APY. With no minimum deposit requirement and zero monthly fees, this account could be a. Why we picked it: The flagship savings account of Alliant credit union offers a top-tier APY without monthly maintenance fees. You can open an Alliant High-Rate. The top savings accounts rates on Raisin. Offered by FDIC-insured banks and NCUA-insured credit unions. Start with as little as $1 and no fees. Learn more. Earn more with % APY63 (that's 15x the bank industry average!71). And with fewer fees, rest easy knowing your money will stay your money. Move. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Interest Rates ; %. %. $1,, $1, ; %. %. $1,, $1, Make the easiest decision with a great savings rate. Savings Account Balance, Annual Percentage Yield (APY). Any balance, NaN. Ally, Synchrony, Barclays, Capital One all have good HYSA's, but you will find that every bank on earth can and will change the APY at any time. Best Savings Account Interest Rates As of Aug. 19, , the national average rate for savings accounts was %, according to the FDIC. You can check out.

Housing Interest Rates News

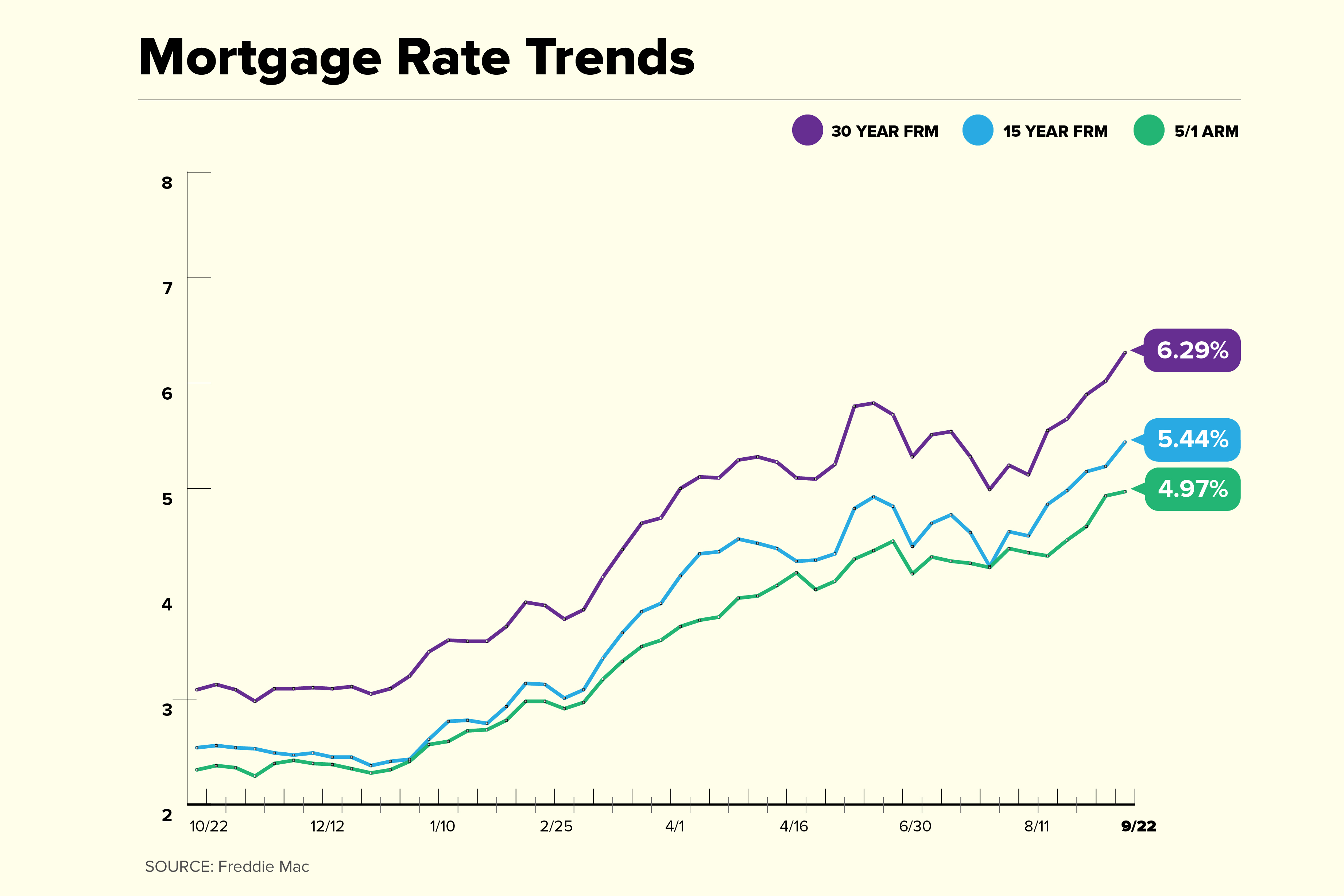

While rates remain elevated, the Federal Reserve (Fed) signaled it may soon cut its key interest rate, which could mean a further downward shift in mortgage. Mortgage rates Recent rate movements have failed to result in significant purchase growth, but refinances are providing lenders some lift. About 85% of U.S. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. In the same period last year, the rate on a year benchmark mortgage was %. “Mortgage rates fell again this week due to expectations of a Fed rate cut,”. 57 minutes ago. It's widely expected that the Fed will cut interest rates before the end of However, at the most recent meeting on this topic in July, the central bank. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Today's Locked Mortgage Rates ; YR. CONFORMING. % − ; YR. CONFORMING. % − ; YR. JUMBO. % + ; YR. FHA. % − The year fixed mortgage rate is expected to fall to the mid-6% range through the end of , potentially dipping into high-5% territory by the end of While rates remain elevated, the Federal Reserve (Fed) signaled it may soon cut its key interest rate, which could mean a further downward shift in mortgage. Mortgage rates Recent rate movements have failed to result in significant purchase growth, but refinances are providing lenders some lift. About 85% of U.S. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. In the same period last year, the rate on a year benchmark mortgage was %. “Mortgage rates fell again this week due to expectations of a Fed rate cut,”. 57 minutes ago. It's widely expected that the Fed will cut interest rates before the end of However, at the most recent meeting on this topic in July, the central bank. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Today's Locked Mortgage Rates ; YR. CONFORMING. % − ; YR. CONFORMING. % − ; YR. JUMBO. % + ; YR. FHA. % − The year fixed mortgage rate is expected to fall to the mid-6% range through the end of , potentially dipping into high-5% territory by the end of

What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. The average rate on a year fixed-rate mortgage fell seven basis points to % APR, and the average rate on a 5-year adjustable-rate mortgage went down. Fixed-term fixed-rate mortgages. · 1-year fixed-term residential, % · 2-year fixed-term residential, % · 3-year fixed-term residential, % · 4-year fixed. Mortgage rate hopes as one lender offers below 4%. Lenders have been lowering their rates ahead of a hoped-for interest rate cut in August. 24 Jul View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. Today's average year fixed-mortgage rate is , the average rate for a year fixed mortgage is percent, and the average 5/1 ARM rate is percent. Category: Interest Rates > Mortgage Rates, 32 economic data series, FRED: Download, graph, and track economic data. Mortgage rates today should remain in their narrow range, with some downward pressure. Rising treasury bond yields partially caused the small interest rate. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, Mortgage rates dropped in the week ending Aug. 29 as markets became increasingly convinced that the Federal Reserve will cut short-term interest rates in. The string of consistent interest rate increases prompted mortgage rates to rise steadily in and , exceeding pre-pandemic levels after hitting record-. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. forecast and long-term prediction, economic calendar, survey consensus and news Alerts. The average contract interest rate for year fixed-rate mortgages. News on current mortgage rates and other factors affecting the current housing market. Today's mortgage interest rates Legal Statement. This material may not be published, broadcast, rewritten, or redistributed. © FOX News Network, LLC. Mortgage rates continue to hover near the lowest levels of the year. The year fixed rate currently sits at %, % APR with points. As of August 30, , the average year-fixed mortgage APR is %. Terms Explained. 3. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. HousingWire's mortgage news coverage spans the market and includes the coverage you need, from what your competition is doing to how they're performing and.