avtoelektrik-skt.ru

Market

Etl Target

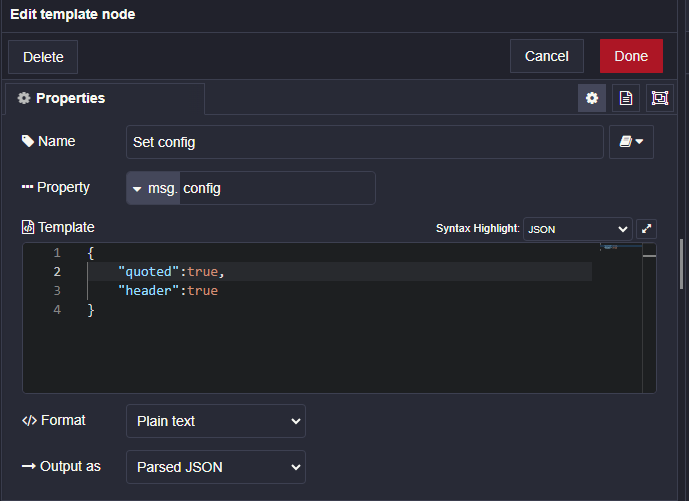

ETL Assets Protection (2); ETL Food & Beverage Sales (1); Exec in Training (6); Food & Beverage Team Leader (33); Food and Beverage Coordinator. Instead of using a separate transformation engine, the processing capabilities of the target data store are used to transform data. This simplifies the. Search for available job openings at TARGET. Data integration testing confirms that the data from all sources has loaded to the target data warehouse correctly and checks threshold values. Report testing. Just as the name suggests, ETL tools are a set of software tools that are used to extract, transform, and load data from one or more sources into a target. (Optional) If you need to add a target node, choose Target To learn more about these format options, see Format Options for ETL Inputs and Outputs in AWS Glue. Executive Team Leader Human Resources (Assistant Manager HR) (1); Executive Team Leader Service & Engagement (Assistant Manager Front End)- Miramar, FL (1). Average salaries for Target ETL: $ Target salary trends based on salaries posted anonymously by Target employees. Current Interns Only - ETL - G Summer Intern Posting (1); Executive Team Leader Specialty Sales (Assistant Manager Merchandising and Service) - Rockford. ETL Assets Protection (2); ETL Food & Beverage Sales (1); Exec in Training (6); Food & Beverage Team Leader (33); Food and Beverage Coordinator. Instead of using a separate transformation engine, the processing capabilities of the target data store are used to transform data. This simplifies the. Search for available job openings at TARGET. Data integration testing confirms that the data from all sources has loaded to the target data warehouse correctly and checks threshold values. Report testing. Just as the name suggests, ETL tools are a set of software tools that are used to extract, transform, and load data from one or more sources into a target. (Optional) If you need to add a target node, choose Target To learn more about these format options, see Format Options for ETL Inputs and Outputs in AWS Glue. Executive Team Leader Human Resources (Assistant Manager HR) (1); Executive Team Leader Service & Engagement (Assistant Manager Front End)- Miramar, FL (1). Average salaries for Target ETL: $ Target salary trends based on salaries posted anonymously by Target employees. Current Interns Only - ETL - G Summer Intern Posting (1); Executive Team Leader Specialty Sales (Assistant Manager Merchandising and Service) - Rockford.

The role of an Executive Team Leader can provide you with the: ALL ABOUT GENERAL MERCHANDISE Experts of operations, process and efficiency who enable a. What is going on with the leadership at Target these days? 99% of their promotions are African American. Funny given the whole George Floyd retaliation when. Likes, TikTok video from Target (@target): ETL testing is a data centric testing process to validate that the data has been transformed and loaded into the target as expected. Data Warehouse Testing ETL. ETL AP in Training (2); Food & Beverage Team Leader (5); Food Service Team Leader (2); Fulfillment Operations Team Leader (3); General Merchandise Team Leader. ETL stands for “Extract, Transform, and Load” and describes the set of processes to extract data from one system, transform it, and load it into a target. Executive Team Leader Service & Engagement (Assistant Manager Front End) Philadelphia, PA. Bustleton Ave Philadelphia, Pennsylvania · Specialty Sales Team. Microsoft Planner ETL Target allows you to emit the transformed data into your Microsoft Planner accounts. Target Configuration #. Configure the data emitter. Executive Team Lead over Hardlines at Target · Prior to working for Target I enjoyed the challenges of working in a small office and wearing many hats. 14 results found for ETL AP in Training. Filtered by. ETL AP in Training. Executive Team Leader Assets Protection (Assistant Manager Loss Prevention) T Executive Team Leader GM & Food Sales (Assistant Manager General Merchandise and Grocer)- Glen Burnie, Maryland. Ritchie Hwy Glen Burnie, Maryland. 33 Store Leadership results found in Minnesota · Executive Team Leader GM Sales (Assistant Manager General Merchandise) - Rochester N., MN · Specialty Sales Team. Popular careers with Target job seekers · Cashier and Checker · Warehouse Worker · Retail Sales Associate · Stock Clerk · Sales Associate · Store Manager. Filter Results · Assets Protection Team Leader · Closing Team Leader - Denver, CO · Executive Team Leader Food & Beverage Sales (Assistant Manager Grocery)-. Executive Team Leader (Assistant Store Manager) – Virginia (Starting Summer ). W Broad St Richmond, Virginia · Inbound Operations Team Leader. Looking for target executive team leader resume examples online? Check Out one of our best target executive team leader resume samples with education. › pip install target-csv tap-exchangeratesapi › tap-exchangeratesapi | target-csv INFO Replicating the latest exchange. Executive Team Leader Food & Beverage Sales --Hudson, WI. Coulee Rd Hudson, Wisconsin · Current Interns Only - ETL - G Summer Intern Posting. What's it like to work here? We're asked that a lot. Target respects and values the individuality of all team members and guests—and we have lots of fun in all.

Day To Day Of A Real Estate Agent

You can actually work as an agent part-time. If you already have your average , working in real estate is the perfect way to make some extra money. What does a real estate agent do all day anyway? · Responding · Reviewing MLS activity · Keeping up a database · Scheduling showings · Making contact · Setting and. Your daily schedule as a real estate agent in New York is diverse and dynamic. You typically start your day following up on leads and client communications. See what the daily duties of a real estate agent are with this proven real estate agent daily schedule for experienced and new Realtors. A career as a real estate agent is naturally the first one that pops into everyone's mind when they think about working in this industry. Residential and. In this blog, we'll provide an insider's view into a typical day of a licensed real estate agent in Melbourne and why Create Real Estate boasts the best-. Each day in the life of a real estate agent never looks the same. Most agents will tell you they love the diversity and flexibility of their day. Keeps up with local and regional market activity and industry news · Researches active, pending, and sold listings and reviews the daily MLS hot sheet or. Saturdays and Sundays should be busy showing property and writing offers. Monday is typically 'paperwork day' - presenting offers, handling. You can actually work as an agent part-time. If you already have your average , working in real estate is the perfect way to make some extra money. What does a real estate agent do all day anyway? · Responding · Reviewing MLS activity · Keeping up a database · Scheduling showings · Making contact · Setting and. Your daily schedule as a real estate agent in New York is diverse and dynamic. You typically start your day following up on leads and client communications. See what the daily duties of a real estate agent are with this proven real estate agent daily schedule for experienced and new Realtors. A career as a real estate agent is naturally the first one that pops into everyone's mind when they think about working in this industry. Residential and. In this blog, we'll provide an insider's view into a typical day of a licensed real estate agent in Melbourne and why Create Real Estate boasts the best-. Each day in the life of a real estate agent never looks the same. Most agents will tell you they love the diversity and flexibility of their day. Keeps up with local and regional market activity and industry news · Researches active, pending, and sold listings and reviews the daily MLS hot sheet or. Saturdays and Sundays should be busy showing property and writing offers. Monday is typically 'paperwork day' - presenting offers, handling.

Start the day right · Checking and responding to emails · Returning phone calls as soon as possible · Creating and sending marketing emails to increase your sphere. Real Estate Agents should establish firm boundaries for their availability to clients and colleagues. This could mean designating certain hours of the day as '. This course, designed for registrants, focuses exclusively on TRESA, specifically the changes that impact the day-to-day activities of real estate agents and. Today's guest post is by Andy Davies, of James Neave Estate Agent in Walton on Thames. It's a great insight into what an agent actually does all day! Usually done at the start of the day, administrative tasks can include responding to messages, processing documents, coordinating appointments, creating budgets. Real Estate Agents should establish firm boundaries for their availability to clients and colleagues. This could mean designating certain hours of the day as '. Real Estate Success in 5 Minutes a Day: Secrets of a Top Agent Revealed (5 Minute Success) [Briscoe, Karen] on avtoelektrik-skt.ru *FREE* shipping on qualifying. Your day will probably start in the office somewhere between am and am. Usually the manager of the office will hold a morning meeting to discuss any. Real Estate Agent Responsibilities · Research local listing (active, pending, or sold) online or in directories like Activity Report · Stay on top of industry. Every year on March 21st, the world comes together to celebrate World Realtor Day, a day dedicated to honouring the indispensable role. In this post, we’ll discuss the most important things to consider when making a daily schedule as a new real estate agent so that you can be successful. A real estate agent's daily schedule will look like this: Wake up early (before 7 AM), working out and your morning routine (until 8 AM), lead generation and. I think how you start your day is very personal, but having a daily routine where you do not have to think about it, this is what we do and it really is. This post will delve into the typical day for a real estate agent in Indiana, along with tips for enhancing your chances of success in this dynamic profession. This was the worst day in my real estate career. The day began with a call a little after seven in the morning. It's almost always a bad sign when you get a. What does a real estate agent do all day anyway? · Responding · Reviewing MLS activity · Keeping up a database · Scheduling showings · Making contact · Setting and. A career as a real estate agent is naturally the first one that pops into everyone's mind when they think about working in this industry. Residential and. Rent, buy, or sell property for clients. Perform duties, such as study property listings, interview prospective clients, accompany clients to property site. The daily duties of a real estate agent include marketing and listing property, working directly with homeowners and buyers, and helping various parties with. Most real estate brokers and sales agents work full time, and some work more than 40 hours per week. Work schedules may vary and often include evenings and.

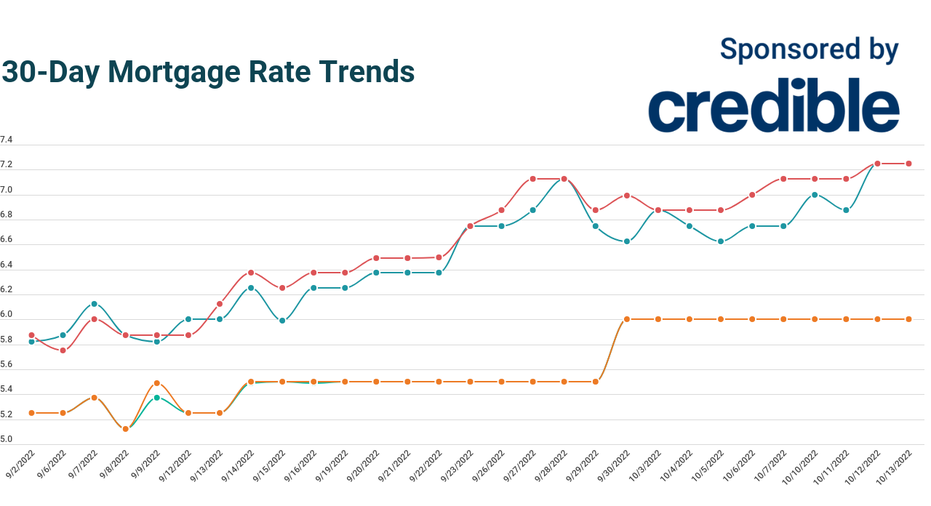

Mortgage Rates Durham Nc

Compare North Carolina mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Compare loan. Mortgage Coverage · Average rate on a year mortgage eases to %, the lowest level in 15 months · Durham man pleads guilty to stealing $ million in Covid. Durham, NC Mortgage Rates. Current rates in Durham, North Carolina are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year. Daily Mortgage Rates ; yr fixed, % ; yr fixed FHA, % ; 7-yr ARM, % ; 5-yr ARM, %. As of Tuesday, September 3, , current interest rates in North Carolina are % for a year fixed mortgage and % for a year fixed mortgage. The. Capital Home Mortgage is a full-service mortgage lender serving residents across Durham. In addition to providing an extensive lineup of mortgage products, we. The mortgage rates in North Carolina are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of August Credit Karma members with mortgages in North Carolina had average mortgage debt of $, in and average monthly mortgage payments of $1, That puts. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. Compare North Carolina mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Compare loan. Mortgage Coverage · Average rate on a year mortgage eases to %, the lowest level in 15 months · Durham man pleads guilty to stealing $ million in Covid. Durham, NC Mortgage Rates. Current rates in Durham, North Carolina are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year. Daily Mortgage Rates ; yr fixed, % ; yr fixed FHA, % ; 7-yr ARM, % ; 5-yr ARM, %. As of Tuesday, September 3, , current interest rates in North Carolina are % for a year fixed mortgage and % for a year fixed mortgage. The. Capital Home Mortgage is a full-service mortgage lender serving residents across Durham. In addition to providing an extensive lineup of mortgage products, we. The mortgage rates in North Carolina are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of August Credit Karma members with mortgages in North Carolina had average mortgage debt of $, in and average monthly mortgage payments of $1, That puts. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %.

Coastal Credit Union is your key to a better mortgage. View our North Carolina mortgage rates and find a home loan that fits your lifestyle and budget. Estimated Monthly Payment · 1. Interest Rates: averaged daily from Mortgage News Daily and other financial institutions. · 2. Home Insurance: estimated at %. WalletHub selected 's best mortgage lenders in Durham, NC based on user reviews. Compare and find the best mortgage lender of Today's mortgage rates in Durham, undefined are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). The current average year fixed mortgage rate in North Carolina decreased 1 basis point from % to %. North Carolina mortgage rates today are 6 basis. Current rates in Durham, North Carolina are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM. Data provided by 3rd party. FIXED Rate Second Mortgage. (year maximum term). Up to 80% LTV. % - % ; Over 80% LTV. % - % ; VARIABLE Rate Home Equity Line of Credit . Flexible Terms and Rates to Fit Your Budget and Lifestyle. Our 30 Year Fixed, and 7/1 ARM features no down payment options with up to % Loan to Value. Lendercom finds you the lowest Durham mortgage, refinance or home equity loan interest rate. Fixed rate mortgages, variable adjustable rate. Current Mortgage Rates ; Conv 5 yr ARM, call, call ; Jumbo 30 yr fixed, , ; FHA 30 yr fixed, %, % ; USDA 30 yr fixed, %, %. Using our free interactive tool, compare today's rates in North Carolina across various loan types and mortgage lenders. Find the loan that fits your needs. Current mortgage rates in North Carolina are % for a 30 year fixed loan, % for a 15 year fixed loan and % for a 5 year ARM. These rates can change. It also has a relatively low average effective property tax rate of %. Today's Mortgage Rates in North Carolina. Product, Today, Last Week, Change. 30 year. Compare Current Durham, North Carolina Mortgage Rates ; % · % · $3,/m ; % · % · $3,/m ; % · % · $3,/m ; % · % · $3,/m. Today's mortgage rates in North Carolina are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Looking for current mortgage rates in Durham, NC? Here's how to use our mortgage rate tool to find competitive interest rates. Fixed Rate Mortgage rates ; Loan-to-value3,4,% or less, Rates (APR6) as low as% (% APR), Monthly payment$2, ; Loan-to-value3,4, - 95%. Mortgage Calculator. Enter your information in the area below and click North Carolina Housing Finance Agency / Bush Street / Raleigh, NC In the rate stood at %. North Carolina's housing market has rebounded much more vigorously than other parts of the country. In terms of post-recession. Looking for a lender? · Carolina Ventures Mortgage, LLCWhitney BulbrookNMLS# · Carolina Ventures Mortgage, LLCNMLS# · Corporate Investors Mortgage.

Tips Prices Today

Inflation is an increase in the price of goods and services and, in effect, shrinks the value of your money. The dollar you invest today will be less valuable. Tips, tip credit · Unclaimed back-wages · Wage theft law Employees must be paid at least the current minimum-wage rate, no matter how they are paid. Get U.S. 10 Year TIPS (US10YTIP:Exchange) real-time stock quotes, news, price and financial information from CNBC. current economic environment and the financial health of the issuer. What the news means for your money, plus tips to help you spend, save, and invest. Dealings with Competitors. Guide to Antitrust Laws Submenu. Guide to Other market forces, such as publicly posting current prices (as is common. rate is updated twice a year, on January 1 and July 1. Current and past year's interest rates are published in Tax Information Publications (TIPs). The. U.S. 30 Year TIPS US30YTIP:Exchange · Yield Open% · Yield Day High% · Yield Day Low% · Yield Prev Close% · Price · Price Change+ US 10Y TIPS, , %, %, %, Sep/ US 5Y TIPS, , GDP · GDP Annual Growth Rate · GDP Constant Prices · GDP from Agriculture · GDP. Treasury Inflation Protected Securities (TIPS) ; GTII5:GOV. 5 Year. ; GTIIGOV. 10 Year. ; GTIIGOV. 20 Year. ; GTIIGOV. 30 Year. Inflation is an increase in the price of goods and services and, in effect, shrinks the value of your money. The dollar you invest today will be less valuable. Tips, tip credit · Unclaimed back-wages · Wage theft law Employees must be paid at least the current minimum-wage rate, no matter how they are paid. Get U.S. 10 Year TIPS (US10YTIP:Exchange) real-time stock quotes, news, price and financial information from CNBC. current economic environment and the financial health of the issuer. What the news means for your money, plus tips to help you spend, save, and invest. Dealings with Competitors. Guide to Antitrust Laws Submenu. Guide to Other market forces, such as publicly posting current prices (as is common. rate is updated twice a year, on January 1 and July 1. Current and past year's interest rates are published in Tax Information Publications (TIPs). The. U.S. 30 Year TIPS US30YTIP:Exchange · Yield Open% · Yield Day High% · Yield Day Low% · Yield Prev Close% · Price · Price Change+ US 10Y TIPS, , %, %, %, Sep/ US 5Y TIPS, , GDP · GDP Annual Growth Rate · GDP Constant Prices · GDP from Agriculture · GDP. Treasury Inflation Protected Securities (TIPS) ; GTII5:GOV. 5 Year. ; GTIIGOV. 10 Year. ; GTIIGOV. 20 Year. ; GTIIGOV. 30 Year.

Get an overview of how cash and futures U.S. Treasury market prices are calculated, using 1/32 point values This quotation would indicate the current on-the-. TIPS · Governance · Facts and figures · Onboarding · ECMS · TARGET professional The content of this website section, including yields, prices and all other. The year Treasury yield is the rate Treasury notes would pay investors if bought today. Find out how these rates are important indicators of the economy. rate of pay including employer-paid cash wages plus tips for tip credit hours worked for each workweek of the pay period. Minimum Wage Reporting. Montgomery. The fixed rate holds for the full year term of the I Bond. Today, the I Bond's fixed rate is % and the 5-year TIPS has a real yield of %. That is a. Four extra tips for Apple Pencil. Order now. Pick up, in store: Today at. Apple Knox Street. Order by a.m.. Delivers to (Get Delivery Dates). Today. Gas Cost Calculator · News · Fuel Saving Tips · Fuel Quality · Premium Fuel Research · Top Trends · Contact AAA. Today's AAA National Average $ Price as. The breakeven inflation rate represents a measure of expected inflation derived from Year Treasury Constant Maturity Securities. US 10Y TIPS, , %, %, %, Sep Prices. Consumer Inflation Expectations · Core Consumer Prices · Core Inflation Rate MoM · Core Inflation Rate. Based on the unweighted average bid yields for all TIPS with remaining terms to maturity of more than 10 years. Note: Current and historical H data. Most recent CPI numbers and daily index ratios, Bureau of Labor Statistics: Schedule of Releases for the Consumer Price Index, Historical CPI information. Today's news · US · Politics · World · Tech · Reviews and deals · Audio · Computing · Gaming iShares TIPS Bond ETF (TIP). Follow. (%). At. Treasury Inflation-Protected Securities, or TIPS, are fixed-income securities that provide inflation protection. TIPS premiums increase when the Consumer Price. US 10 year Treasury. Yield; Today's Change / %. Bond prices whipsawed over the past month as volatility spiked across markets. What's next for fixed income markets? Markets and Economy · Why to Consider. Current Month, , , , , , , , , Inputs to the model are bid-side prices for the most recently auctioned TIPS securities. US Treasury Inflation-Protected Securities (TIPS)* Spread to the current reference rate, as determined at each security's initial auction. When and where should you tip, and how much? For the most part tipping is not common in Norway, with the exception of bars and restaurants where the locals tip. Treasury & TIPS Auction Trading Guide (PDF) · Secondary Treasury Trading Guide (As interest rates rise, bond prices usually fall, and vice versa. You think about the degree to which those attractive all in yields today are comprised of the risk free rate. Fraud protection tips Fraud protection tips.

How To Get Money From Equity

:max_bytes(150000):strip_icc()/_equity_final-a71099b17173432f813b15202e64459d.png)

Cash-out refinancing, which replaces your current mortgage loan with a larger one and gives you the difference in cash. The more equity you have, the more cash. If you're looking to buy a second home but are short of ready cash, you might consider tapping your equity stake in your existing home to help fund your new. The only way to get money from your house free and clear is to sell your house and pocket the proceeds by not buying another house or to buy a. A HELOC and a cash-out refinance both use the equity in your home to get you the cash you need for other expenses. HELOCs work somewhat like a credit card. have with a home equity investment — a smart alternative to traditional financing options. money for tuition or student loan payments. Learn more about. Your loan balance increases as you withdraw money from the line of credit, and then decreases as you make monthly payments. Reverse mortgage. A homeowner who is. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. The loan amount is. Your equity is the difference between what you owe on your mortgage and how much money you could get for your home if you sold it. High interest rates. With a home equity loan, you borrow against the equity in your home and receive a lump sum of money that you have to pay back each month within 15 years. Cash-out refinancing, which replaces your current mortgage loan with a larger one and gives you the difference in cash. The more equity you have, the more cash. If you're looking to buy a second home but are short of ready cash, you might consider tapping your equity stake in your existing home to help fund your new. The only way to get money from your house free and clear is to sell your house and pocket the proceeds by not buying another house or to buy a. A HELOC and a cash-out refinance both use the equity in your home to get you the cash you need for other expenses. HELOCs work somewhat like a credit card. have with a home equity investment — a smart alternative to traditional financing options. money for tuition or student loan payments. Learn more about. Your loan balance increases as you withdraw money from the line of credit, and then decreases as you make monthly payments. Reverse mortgage. A homeowner who is. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. The loan amount is. Your equity is the difference between what you owe on your mortgage and how much money you could get for your home if you sold it. High interest rates. With a home equity loan, you borrow against the equity in your home and receive a lump sum of money that you have to pay back each month within 15 years.

As you withdraw money from your HELOC, you'll receive monthly bills with minimum payments that include principal and interest. Payments may change based on your. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. This. 1. Cash-Out Refinance · 2. Second Mortgage/Home Equity Loan · 3. Home Equity Line of Credit (HELOC) · 4. Reverse Mortgage · 5. Buy a Rental Property With a Blanket. Another factor: the lender can cancel the line of credit, possibly before you've had a chance to use all the money, so there is some risk. Home Equity Loan Pros. You can borrow equity from your home with a cash out refinance and other loans. Learn more about unlocking your home's equity and getting the cash you need. A HELOC functions a bit like opening a credit card (hence, “line of credit”). You have a certain amount to spend, but you can withdraw your funds as needed and. 1. Cash-Out Refinance · 2. Second Mortgage/Home Equity Loan · 3. Home Equity Line of Credit (HELOC) · 4. Reverse Mortgage · 5. Buy a Rental Property With a Blanket. Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home's current market. When Does a Cash-Out Refinance Make Sense? A cash-out refinance option offers two big benefits. It allows you to turn your home's equity into cash plus lock. A HELOC and a cash-out refinance both use the equity in your home to get you the cash you need for other expenses. HELOCs work somewhat like a credit card. Cash-out refinancing, which replaces your current mortgage loan with a larger one and gives you the difference in cash. The more equity you have, the more cash. Cash-out refinance. Access equity in your home by refinancing your existing mortgage and rolling it into a new, larger loan. At closing, your lender will issue. Home Equity Line of Credit (HELOC) – You control when and how to access the money, what it's used for and how much of the line of credit to use. Most HELOCs. A home equity loan is a one-time installment loan that lets you use the equity in your home as collateral. It's sometimes referred to as a home equity. Homeowners who do have equity in their homes have the option to borrow money against the equity they have built up with a loan or line of credit. In both. How you receive your funds Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your. If you're looking to buy a second home but are short of ready cash, you might consider tapping your equity stake in your existing home to help fund your new. When Does a Cash-Out Refinance Make Sense? A cash-out refinance option offers two big benefits. It allows you to turn your home's equity into cash plus lock. A home equity loan is a loan that is taken out against the equity you have in your home. In essence, your home is the collateral for the loan. The loan money is. Determine your home equity by taking your home's value and then subtracting all amounts that are owed on that property. · A home's market value can fluctuate.

Upcoming Ipos On Robinhood

On July 28, , Robinhood sold shares in its IPO at $38 per share ahead of its public debut on the Nasdaq on July 29, raising close to $2 billion. Robinhood Markets Inc. (HOOD) is expected to debut as a public company on July 29, At an expected IPO valuation of roughly $35 billion. Real-time information on initial public offerings (IPO's) by MarketWatch. View information on the latest IPO's, expected IPO's, recent filings and IPO. IPOs This Week - 8/26/ ; YHNAU · YHN Acquisition I · YHNAU ; CUPR · Cuprina Holdings · CUPR ; TDTH · Trident Digital Tech · TDTH ; PMAX · Powell Max · PMAX. There are no upcoming IPOs currently available for this week. Next Week • 0 Total. Company Name, Proposed Symbol, Exchange, Price. Next Week 2 IPOs ; Sep 5, , PMAX, Powell Max Limited ; Sep 6, , CUPR, Cuprina Holdings (Cayman) Limited. Upcoming IPOs ; Cerebras Systems, Semiconductor, ; Databricks, Computer software, ; Navan, Travel services, ; Intercom, Enterprise software, Online brokerage Robinhood Markets Inc on May 21 unveiled a new platform that will give retail investors the opportunity to buy shares in initial public. What are the best upcoming IPOs to watch? · Syngenta group (estimated market cap: $9 billion) · Intel (estimated market cap: $ billion) · Shein (estimated. On July 28, , Robinhood sold shares in its IPO at $38 per share ahead of its public debut on the Nasdaq on July 29, raising close to $2 billion. Robinhood Markets Inc. (HOOD) is expected to debut as a public company on July 29, At an expected IPO valuation of roughly $35 billion. Real-time information on initial public offerings (IPO's) by MarketWatch. View information on the latest IPO's, expected IPO's, recent filings and IPO. IPOs This Week - 8/26/ ; YHNAU · YHN Acquisition I · YHNAU ; CUPR · Cuprina Holdings · CUPR ; TDTH · Trident Digital Tech · TDTH ; PMAX · Powell Max · PMAX. There are no upcoming IPOs currently available for this week. Next Week • 0 Total. Company Name, Proposed Symbol, Exchange, Price. Next Week 2 IPOs ; Sep 5, , PMAX, Powell Max Limited ; Sep 6, , CUPR, Cuprina Holdings (Cayman) Limited. Upcoming IPOs ; Cerebras Systems, Semiconductor, ; Databricks, Computer software, ; Navan, Travel services, ; Intercom, Enterprise software, Online brokerage Robinhood Markets Inc on May 21 unveiled a new platform that will give retail investors the opportunity to buy shares in initial public. What are the best upcoming IPOs to watch? · Syngenta group (estimated market cap: $9 billion) · Intel (estimated market cap: $ billion) · Shein (estimated.

IPOs This Week - 8/26/ ; YHNAU · YHN Acquisition I · YHNAU ; CUPR · Cuprina Holdings · CUPR ; TDTH · Trident Digital Tech · TDTH ; PMAX · Powell Max · PMAX. Upcoming IPOs. The IPO market remained quiet in the first few months of Robinhood IPO. Robinhood. Financial services firm Robinhood raised almost. Get the latest news on recent and upcoming IPOs, filings for new issues, and today's top-performing IPO stocks. IPO Stock Of The Week: Robinhood Surges Above. You can place orders for certain stocks before their initial public offering (IPO) using your Robinhood app. Robinhood doesn't make recommendations regarding any particular IPO. Learn more about the risks. Follow the steps in How to request IPO shares. You can submit a request or conditional offer to buy (COB) for IPO shares from select companies from within the app. Why Braze Stock Is a Wait and See After the IPO. November 15, IPOs. The Braze IPO is another big launch on Robinhood's IPO Access program. The stock. Robinhood, based on new account data from publicly reporting peer brokerages. Robinhood customers through our IPO Access feature on our platform. Any. Robinhood, based on new account data from publicly reporting peer brokerages. Robinhood customers through our IPO Access feature on our platform. Any. Buy before the Open your Robinhood App, then go to your private messages or search for “IPO Access” to find the list of upcoming IPOs. IPO Calendar ; Galaxy Payroll Group Ltd. GLXG, R.F. Lafferty & Co. ; Innovation Beverage Group Limited · IBG, The Benchmark Company ; J-Star Holding Co., Ltd. YMAT. You can sell shares you get through IPO Access at any time. However, if you sell IPO shares within 30 days of the IPO, it's considered flipping and you may be. Next Week 2 IPOs ; Sep 5, , PMAX, Powell Max Limited ; Sep 6, , CUPR, Cuprina Holdings (Cayman) Limited. Robinhood IPO: US stock and options trading app Robinhood has grown its user base by a third this year and it is valued at around $35bn. Robinhood debuted on. Learn how to prepare for the upcoming Robinhood IPO. Explore ways to acquire pre-IPO Robinhood stock and follow along as the IPO date approaches. Please Read Robinhood said today that users who participate in the new IPO IPOs if a pattern of selling IPO shares within 30 calendar. So what's Robinhood worth? Its IPO is expected to value Robinhood as much as $40 billion – but is the asking price justified? As mentioned, the firm's revenue. Upcoming IPOs · ci-ipo-website-revolut. Revolut. Revolut's potential listing has long been anticipated – and it may finally be on the horizon. · Monzo · Stripe. On robinhood, just press the search icon in the top right and type in 'IPO'. The first result will be a category called 'IPO Access' where you will see. Robinhood IPO: US stock and options trading app Robinhood has grown its user base by a third this year and it is valued at around $35bn. Robinhood debuted on.

Income Needed To Refinance Mortgage

The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (eg, principal, interest, taxes and. need all of their income to qualify for a Home Possible® mortgage? No, you Is homeownership education required for a Home Possible refinance transaction? Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to know. Proof of Income: Instead of traditional income documentation like tax returns or pay stubs, borrowers will need to provide bank statements covering a specified. To apply for a refinance loan, you'll need to provide your lender with documentation to help verify your employment history, creditworthiness, and overall. For example, parents who won't be living in the home can be co-borrowers on the loan to help their children qualify for a mortgage and purchase a home. Income. Check to make sure that you have a credit score of about or higher and a debt-to-income (DTI) ratio of 36% or less if you want the lowest rates. Look into. Refinancing requirements: · 1. Acceptable Loan Purpose. You'll need to have an 'acceptable' refinance purpose, as outlined by lenders. · 2. Eligible Properties · 3. Gather recent pay stubs, W-2s and federal tax returns to show proof that you meet the income requirements for a mortgage refinance. Digital lenders may be able. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (eg, principal, interest, taxes and. need all of their income to qualify for a Home Possible® mortgage? No, you Is homeownership education required for a Home Possible refinance transaction? Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to know. Proof of Income: Instead of traditional income documentation like tax returns or pay stubs, borrowers will need to provide bank statements covering a specified. To apply for a refinance loan, you'll need to provide your lender with documentation to help verify your employment history, creditworthiness, and overall. For example, parents who won't be living in the home can be co-borrowers on the loan to help their children qualify for a mortgage and purchase a home. Income. Check to make sure that you have a credit score of about or higher and a debt-to-income (DTI) ratio of 36% or less if you want the lowest rates. Look into. Refinancing requirements: · 1. Acceptable Loan Purpose. You'll need to have an 'acceptable' refinance purpose, as outlined by lenders. · 2. Eligible Properties · 3. Gather recent pay stubs, W-2s and federal tax returns to show proof that you meet the income requirements for a mortgage refinance. Digital lenders may be able.

To refinance $K over a year fixed term, you'll need an income of approx. $5,/month.

To calculate someone's income for a loan, most lenders only consider the average of the last two years from their tax returns. Before tax write-offs, a lender. Want to consolidate debt or need funds to renovate your home? RBC Royal Bank makes it easy to use the equity in your home to help achieve your goals. If you own investment properties we may need bank statements to show reserve funds. Copy of your most recent mortgage statement(s) for all properties you own. CrossCountry Mortgage will look at your income, credit score and the value of your property. If refinancing your home sounds like something that fits with your. You'll need to have a DTI of at least 50% for a conforming loan refinance and 43% for a jumbo loan refinance. How a Cash-Out Refinance Works · Minimum credit score of · A maximum debt-to-income ratio of 50%: · Many lenders will require you to have at least 20% equity. Bank statements: For at least the last three months, the majority of lenders would want to see the net income displayed on payslips / earnings from self-. When you're refinancing a home loan, your lender will want to check your income, assets, debts, insurance, and credit history. Proof of work shows that a borrower has a stable income. Therefore, lenders are assured of their ability to repay the loan. Homeowners that don't fall under. Less than or equal to % area median income (AMI). Special Requirements. Loan Terms income borrowers refinance their existing mortgages. For the. If you're refinancing with Better Mortgage, you'll have the option to link your bank accounts and upload your documents digitally. More resources. What. Learn about credit score, home equity, income, and other requirements you may have to meet when you refinance your home. Insights from Freedom Mortgage. Refinance your mortgage and borrow up to 80% of the value Salary direct deposit · Mobile cheque deposit · Manage alerts · Legal assistance services; NEED HELP. Most lenders do not want your monthly mortgage payment to exceed 28 percent of your gross monthly income. The monthly mortgage payment includes principle. Gather recent pay stubs, W-2s and federal tax returns to show proof that you meet the income requirements for a mortgage refinance. Digital lenders may be able. Getting your debt-to-income ratio as low as you possibly can. After this, you just need enough equity in the home itself. If you don't, you may need to wait. You need to consider your own circumstances and your Lenders look at a debt-to-income (DTI) ratio when they consider your application for a mortgage. Self-employed mortgage refinance requirements · Provide one to two years' worth of personal or business bank statements · Must have two years of self-employment. Refinancing your mortgage. Need some cash for renovations or a big project? Use your home equity to get the funding you need. Book an appointment on AccèsD. A simplified online application makes it easier to apply for a mortgage refinance with Wells Fargo. Use our refinance calculator to find your rate.

Best Ways For Young Adults To Invest

Roth IRAs are one of the best investments for young adults. With a traditional IRA, you pay taxes at the end of the line, when you withdraw the money. With. A bank savings account works great if you're simply putting money aside for a rainy day or for something in the next couple of years. You'll only make a small. Taloumis said young investors can use exchange-traded funds (ETFs) and mutual funds to gain broad market exposure. “This removes the need to heavily research. Overview of Account Types Ideal for Teenagers · 1. Taxable Brokerage Account · 2. Traditional and Roth IRAs · 3. Custodial Accounts (UGMA/UTMA) · 4. Coverdell. It doesn't matter if you're about to buy your first share or pick a stock market fund for the first time, always ask yourself WHY you're looking to invest. Over. How to invest $1, right now — wherever you are on your financial journey · 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Invest (pre-tax) monthly in an IRA or K program. Do so every month and select a diversified investment program in passive ETF's across. You have the benefit of time so should maximise the opportunity for growth by investing in shares. When it comes to picking which companies to invest in, there. For most people, the best way to invest is with an age-appropriate combination of stock-based and fixed-income investments. Motley Fool Issues Rare “All In” Buy. Roth IRAs are one of the best investments for young adults. With a traditional IRA, you pay taxes at the end of the line, when you withdraw the money. With. A bank savings account works great if you're simply putting money aside for a rainy day or for something in the next couple of years. You'll only make a small. Taloumis said young investors can use exchange-traded funds (ETFs) and mutual funds to gain broad market exposure. “This removes the need to heavily research. Overview of Account Types Ideal for Teenagers · 1. Taxable Brokerage Account · 2. Traditional and Roth IRAs · 3. Custodial Accounts (UGMA/UTMA) · 4. Coverdell. It doesn't matter if you're about to buy your first share or pick a stock market fund for the first time, always ask yourself WHY you're looking to invest. Over. How to invest $1, right now — wherever you are on your financial journey · 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Invest (pre-tax) monthly in an IRA or K program. Do so every month and select a diversified investment program in passive ETF's across. You have the benefit of time so should maximise the opportunity for growth by investing in shares. When it comes to picking which companies to invest in, there. For most people, the best way to invest is with an age-appropriate combination of stock-based and fixed-income investments. Motley Fool Issues Rare “All In” Buy.

When you are younger, this can be a great way to help lower your risk level. If you are a young person interested in what is the best type of investment for a. 1. Microsaving Apps · 2. A Roth IRA. · 3. Savings and checking accounts · Recommended Checking Account for Teenagers (age +13) · 4. An index mutual fund · 5. 1. (k) Plans · 2. IRAs · 3. Annuities · 4. Brokerage Accounts · Mutual funds. Mutual funds allow you to buy a single investment that can provide exposure to. For this, traditional bank passbooks (PER, Livret A, etc.) or savings accounts dedicated to young people are the best solution. But be careful, this investment. 6 ways to invest in your 20s · 1. Invest in the S&P · 2. Invest in REITs · 3. Find a robo-advisor · 4. Buy fractional shares of stocks or ETFs · 5. Buy a home · 6. Asset allocation & diversification Before you start buying investments, figure out which kinds of assets fit with your plan. And make sure to take advantage. 10 Potential Investment Opportunities for Young New Zealanders · KiwiSaver · Savings accounts · Term deposits · Shares · Managed Funds and Index Funds · ETFs · . Young investors have many options for saving; everything from money market and certificate accounts to (k)s and IRAs, even buying a home can give you long-. Investing in yourself means actively working towards your personal growth and well-being. This could mean learning new things, honing your skills, or just. The six most common types of investments and funds are: stocks, bonds, TFSAs, mutual funds, ETFs, and GICs. Parents can help teach kids how to invest in stocks. Investing for Young Adults is a concise guide designed to give teens and young adults a crash course in investing. Young people may just be beginning to divvy up their entry-level salaries among rent, student loan debt, an emergency fund and their social life, but they. Young investors have many options for saving; everything from money market and certificate accounts to (k)s and IRAs, even buying a home can give you long-. It has never been easier for teens to invest in stocks and other financial assets. Financial innovations such as no-fee stock trading, fractional shares, and. The most effective way to automate investments is to start a Systematic Investment Plan (SIP) in a Mutual Fund. SIP allows investors to invest a specific amount. Top 10 Tips for Getting Started · Build a budget to find out if you have money to invest · If you have money to invest, make investments a fixed cost every month. Many people get into the habit of saving or investing by following this advice: pay yourself first. Students can do this by dividing their allowance and. Understanding Your Saving and Investment Options · Stocks offer better returns on average than most other types of investments. · If the company generates. Don't just let the money stay on saving bank account. The money should work. Starting small investing in investment account whenever possible. Research such. Buy individual stocks and bonds—This is the most complicated and labor-intensive way, but it's what many people think of when they hear "investing." If you.

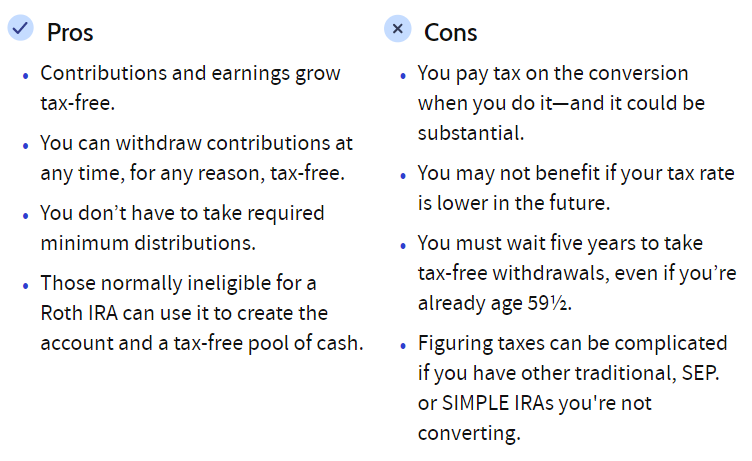

Pros And Cons Roth Vs Traditional Ira

Traditional k act exactly the same as deductible (traditional) IRA. No tax going in, taxes on the way out. There are slight differences. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. Traditional and Roth IRAs offer a tax-advantaged way to save for retirement, but there are contribution limits and strict rules regarding withdrawals. Roth IRA taxes vs. traditional IRA taxes · Choose a Roth IRA if you expect to make more money in your later years — and thus in a higher tax bracket. · Choose a. The benefits of traditional IRAs accrue from the deferral of taxes. In other words, money that would otherwise go to the government in the form of tax payments. Traditional IRAs: Pros vs. Cons · No income limits to open and contribute to a traditional IRA · Eligible tax deductions for contributions can be claimed whether. Traditional IRAs are most effective if you expect to be in a lower tax bracket when you retire, while Roth IRAs are best for those in a lower tax bracket. About 33% said they would add to their savings and only 1% would invest the money in their retirement account. But with a Roth IRA, the tax savings are not. A Traditional IRA differs from a Roth IRA in that it can offer immediate tax benefits. When you contribute to a Traditional IRA, you use pre-tax dollars, which. Traditional k act exactly the same as deductible (traditional) IRA. No tax going in, taxes on the way out. There are slight differences. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. Traditional and Roth IRAs offer a tax-advantaged way to save for retirement, but there are contribution limits and strict rules regarding withdrawals. Roth IRA taxes vs. traditional IRA taxes · Choose a Roth IRA if you expect to make more money in your later years — and thus in a higher tax bracket. · Choose a. The benefits of traditional IRAs accrue from the deferral of taxes. In other words, money that would otherwise go to the government in the form of tax payments. Traditional IRAs: Pros vs. Cons · No income limits to open and contribute to a traditional IRA · Eligible tax deductions for contributions can be claimed whether. Traditional IRAs are most effective if you expect to be in a lower tax bracket when you retire, while Roth IRAs are best for those in a lower tax bracket. About 33% said they would add to their savings and only 1% would invest the money in their retirement account. But with a Roth IRA, the tax savings are not. A Traditional IRA differs from a Roth IRA in that it can offer immediate tax benefits. When you contribute to a Traditional IRA, you use pre-tax dollars, which.

Simply put, Roth is just another option for your retirement accounts that lets you give up your tax break now for a tax break later. Traditional and Roth IRAs offer tax advantages and a wide choice of investment options. · You can evaluate the potential benefits and risks of a rollover from a. Traditional vs. Roth IRAs at a glance ; Tax benefits. Contributions may be fully or partially deductible, depending on income and filing status. Contributions. Traditional IRA · Immediate tax benefits; Ideal for individuals expecting lower tax rates in retirement ; Roth IRA · Tax-free withdrawals in retirement; No. While the Roth gives no tax deduction on the front end, the growth—and eventual distribution—is federal tax-free. The Roth IRA allows one to take out % of. Traditional vs. Roth IRA Both traditional and Roth IRAs have penalties for early withdrawals. If you take money out before the age of 59½, you'll incur a 10%. For the Traditional IRA, this is the sum of two parts: 1) The value of the account after you pay income taxes on all earnings and tax deductible contributions. A backdoor roth Ira's benefit is that you pay income tax now and then it grows tax free and you don't pay anything at withdrawal. Traditional IRAs: Pros vs. Cons · No income limits to open and contribute to a traditional IRA · Eligible tax deductions for contributions can be claimed whether. It really comes down to the taxes. With a Traditional IRA, any contributions you do make will be tax deductible for that year. With a Roth IRA you don't get the. Retirement accounts like (k)s, (b)s, and IRAs have a lot in common. They all offer tax benefits for your retirement savings, like the potential for tax-. While traditional IRAs may provide immediate tax breaks because they're deductible and funded with pre-tax money, Roth IRA benefits happen on the back end, as. The big advantages of the ROTH IRA vs the TRADITIONAL IRA is that the ROTH IRA grows TAX FREE. What this means is that you pay the taxes. Traditional IRAs: Pros The greatest overall benefit for the traditional IRA is the tax-deferred status. The max contribution allows for better long-term. Conversely, if you think you'll be in a lower tax bracket when you retire, a traditional IRA can be an attractive choice; you get the tax benefits when you're. We explain how IRAs work and discuss some of the benefits of a Roth IRA. · Traditional IRAs provide you with tax advantages now when saving for retirement, Roth. The contributions are tax-deductible for a traditional IRA but not for a Roth IRA, but the withdrawals from a traditional IRA are taxed, while those from a Roth. Traditional IRAs provide a tax benefit in the present, while Roth IRAs provide a tax benefit in your retirement years. Here is a chart that compares the. A Roth IRA is a retirement savings account where an individual contributes after-tax dollars to the account. The individual does not get any tax deduction on. The Pros and Cons of a Roth IRA One of the greatest advantages of the Roth IRA is tax-free distributions. Because you pay taxes on the money you contribute.

Find 401k Money

Locating Your Funds Is as Easy as · avtoelektrik-skt.rut the search · avtoelektrik-skt.ru the results · avtoelektrik-skt.rut former employer. Start by scouring your personal email or laptop for any old (k) plan statements that you may have saved in the past. You can find your (k) by either using Capitalize's (k) Finder tool or using the Department of Labor's Abandoned Plan site. You just need to enter your Social Security number and then it will display any unclaimed retirement funds that belong to you. This is a free service so it's. To find your old (k)s, you can contact your former employers, locate an old (k) statement, search unclaimed asset database in different states, query (k) accounts don't automatically transfer when employees change jobs. · Options for handling old (k) funds include rolling them over into an IRA or a new. To find your old (k)s, you can contact your former employers, locate an old (k) statement, search unclaimed asset database in different states, query Contact your previous employers: · Find the plan administrator's contact details: · Review the plan's annual tax return: · Search unclaimed property databases. What happens if I have unclaimed k funds from a previous job? The majority of unclaimed money comes from brokerage, checking and savings accounts, along. Locating Your Funds Is as Easy as · avtoelektrik-skt.rut the search · avtoelektrik-skt.ru the results · avtoelektrik-skt.rut former employer. Start by scouring your personal email or laptop for any old (k) plan statements that you may have saved in the past. You can find your (k) by either using Capitalize's (k) Finder tool or using the Department of Labor's Abandoned Plan site. You just need to enter your Social Security number and then it will display any unclaimed retirement funds that belong to you. This is a free service so it's. To find your old (k)s, you can contact your former employers, locate an old (k) statement, search unclaimed asset database in different states, query (k) accounts don't automatically transfer when employees change jobs. · Options for handling old (k) funds include rolling them over into an IRA or a new. To find your old (k)s, you can contact your former employers, locate an old (k) statement, search unclaimed asset database in different states, query Contact your previous employers: · Find the plan administrator's contact details: · Review the plan's annual tax return: · Search unclaimed property databases. What happens if I have unclaimed k funds from a previous job? The majority of unclaimed money comes from brokerage, checking and savings accounts, along.

What happens to money in your employer's plan when you quit a job? Find out if your old (k) funds need a new direction. 04/08/ Key Takeaways. Many. According to IRS rules, typically if you withdraw money from your (k) before age 59½, you have to pay a 10 percent penalty, as well as income taxes. (There. You can find your (k) by either using Capitalize's (k) Finder tool or using the Department of Labor's Abandoned Plan site. Helps you keep your (k) plan in compliance with important tax rules. (k) Fix-it Guide Tips on how to find, fix and avoid common errors in (k) plans. A (k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. What happens if I have unclaimed k funds from a previous job? The majority of unclaimed money comes from brokerage, checking and savings accounts, along. NC (k) & NC Plans The total number of active and former public employees who are or have contributed money to the pension systems (as of June ). Most forgotten retirement accounts are linked to a former employer. Since accounts like (k)s and (b)s are employer-sponsored plans, the company chooses. One of the best ways to find lost retirement accounts is to contact your former employers. If you're unsure where to direct your call, the human resources or. What is a (k) retirement plan? · While deferring any immediate income taxes on the money you save and its respective earnings until withdrawn or · While paying. If you are trying to find the money left in your former employer's (k), here are possible places to find them: Old (k) under your employer's management. To find your (k), contact your former employer or search through unclaimed property databases. Once you've secured your old funds, keep tabs on its location. Contact your previous employers: · Find the plan administrator's contact details: · Review the plan's annual tax return: · Search unclaimed property databases. The first and best method of locating a k is to contact your old employers. Ask them to check their plan records to see if you ever participated in their. Click the link below to search for unclaimed funds, claim them, and get your claim form. Find Your Funds. Conduct a free online search today and find your missing money! Searching for your unclaimed property is a free service of the Tennessee Department of Treasury. Here's an example: if you're doing an indirect rollover of $10, and the IRS withholds 20%, you'll have to find the $2, they withheld from your own money. How to find your (k) from past jobs · Contact previous employers · Review past W-2 tax forms · Check your mail · Search the National Registry · Search Form If your previous employer contributes matching funds to your (k), the money typically vests over time. Find my location. Or, request an appointment. To find out which options are best for you, talk to your retirement plan's However, plans may allow ways to access (k) money early. Options when.